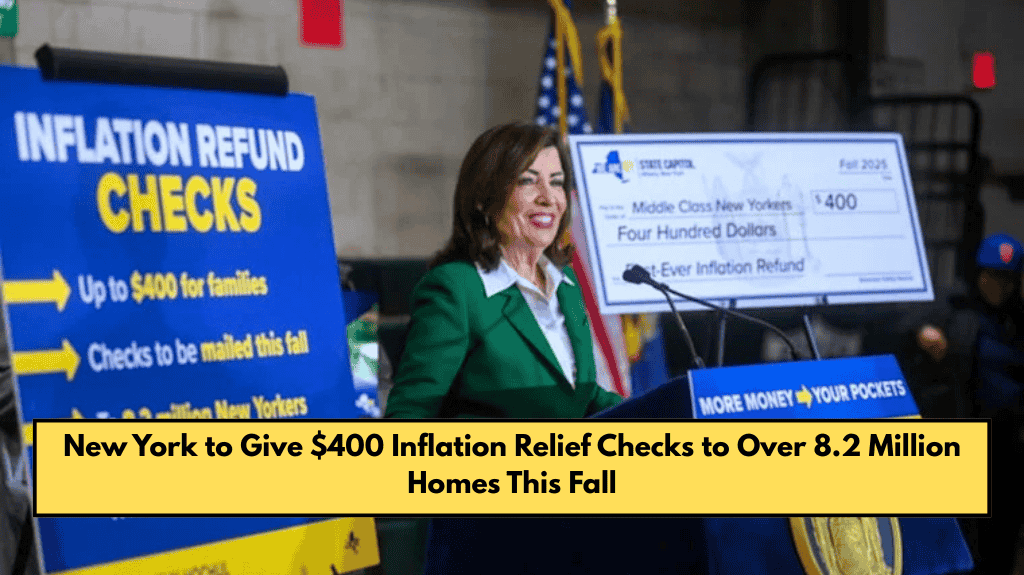

This fall, millions of New York families will receive some financial help from the government. Governor Kathy Hochul has announced that around 8.2 million households in the state will get rebate checks of up to $400. These payments are part of the state’s plan to help people manage rising living costs and will be sent out by mail between October and November 2025.

The best part? You don’t need to apply or fill out any forms. If you are eligible, the check will be mailed to you automatically.

Why Are These Rebate Checks Being Given?

These $400 checks are part of the New York State Budget for the 2026 financial year. With prices rising everywhere, this move is meant to give families some relief. The goal is to return money to residents who qualify based on their income and tax returns. The government expects millions of people to benefit from this plan.

Who Will Receive These $400 Payments?

The payments will go to taxpayers who meet the income limits set by the New York State Department of Taxation. There is no age limit to receive the check. If your income and tax status match the rules, you will get your payment.

Here is a look at how many households will get payments in different regions:

- New York City – 3.53 million

- Long Island – 1.25 million

- Mid-Hudson – 924,000

- Western New York – 585,000

- Finger Lakes – 513,000

- Capital Region – 475,000

- Downtown New York – 321,000

- Southern Tier – 251,000

- Mohawk Valley – 198,000

- Northern Country – 156,000

These payments are not sent based on postal code, so even neighbors might receive them on different dates depending on how the system processes the checks.

Who is Eligible for the Payment?

To get the rebate, you must meet the following conditions:

You should have filed Form IT-201 for the 2023 tax year.

You should not have been claimed as a dependent by someone else.

Your income should fall within the allowed limits.

How much money you receive depends on your income and marital status:

Married couples:

Income up to $150,000 – $400 check

Income between $150,001 and $300,000 – $300 check

Single taxpayers:

Income up to $75,000 – $200 check

Income between $75,001 and $150,000 – $150 check

What Other Tax Benefits Are Available?

Apart from the $400 rebate, the state is also offering more financial help:

Middle-class tax cuts

The New York Child Tax Credit has been increased to $1,000 per child

Free school meals for all students

These benefits were added after talks with the Legislative Assembly and Senate members. The aim is to ease the financial pressure on low- and middle-income families.

Governor Hochul shared, “Starting in October, more than 8 million New Yorkers will receive an inflation rebate because it’s simple: this is your money, and we’re putting it back in your pockets.”

This $400 inflation rebate is a major effort by the New York government to support families during tough times. Over 8 million households will get financial relief without having to take any extra steps.

The money will be sent directly to those who qualify, and additional benefits like child tax credits and free school meals show that the state is taking real steps to help working families. These programs are a big step toward easing the burden of everyday costs for people across the state.