Buying a home in the United States has become tougher for many people. Home prices are rising quickly, and mortgage rates are still high. Because of this, many families find it difficult to afford a house. In 2025, most buyers will need to earn a six-figure salary just to buy an average three-bedroom home in almost every state. This article explains how much money you need to buy a typical home across the country and which states are the hardest to afford.

The Growing Gap Between Income and Home Prices

A recent study shows that almost half of American households cannot afford a home priced at $250,000. This is a big problem because the average price for a new single-family home in the U.S. is about $495,750. That means most families need a much higher income than before to buy a house. The gap between what families earn and what homes cost is getting wider in many parts of the country.

How Much Income Is Needed to Buy a Home?

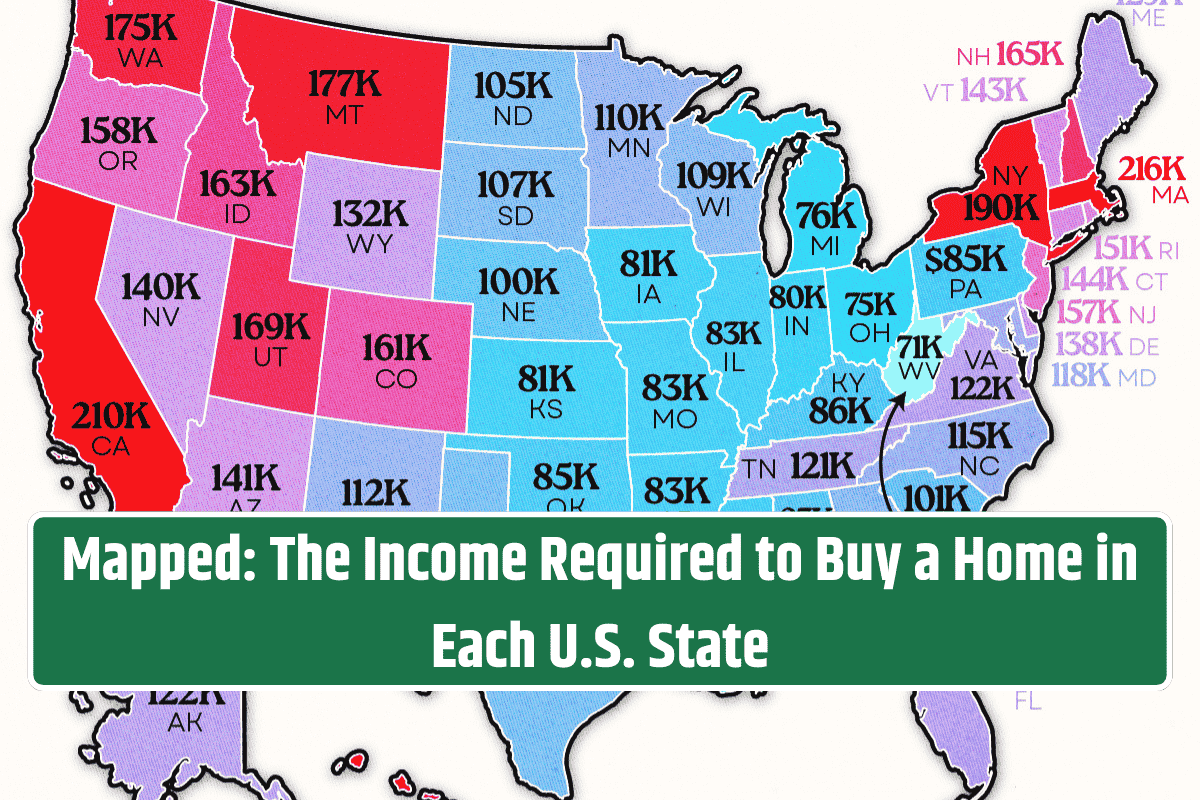

This analysis uses data from Realtor.com to estimate the annual income needed to buy a median-priced three-bedroom home in each state. The calculation assumes a 10% down payment, a mortgage interest rate of 6.65% for a 30-year loan, and that housing costs should not take more than 30% of a family’s income. The total housing costs include mortgage payments, taxes, and insurance.

States Where You Need the Highest Salaries to Buy a Home

In 2025, some states require much higher incomes to afford an average home. Here are the top five states where you need the biggest salary:

Hawaii tops the list, where you need about $229,000 a year to afford a median home. Massachusetts and California follow, needing $216,000 and $210,000 respectively. New York requires $190,000, and Montana, surprisingly, ranks fifth at $177,000. Montana’s rise is due to home prices going up fast, while local incomes have not increased as much.

States Where Buying a Home is More Affordable

On the other hand, some states still offer affordable housing. For example, in West Virginia, you only need about $71,000 a year to buy a typical home. This is less than the state’s median household income of $90,000. Other states with lower income requirements include Mississippi, Ohio, and Indiana. These places have home prices that are easier to match with local incomes.

The housing market in the U.S. is becoming more difficult to enter for many families. Rising home prices and high mortgage rates mean that a large income is now needed to buy an average home. While some states like Hawaii and California require very high salaries, others still have homes that are affordable compared to local incomes. This gap between income and home prices is an important issue that affects many Americans’ ability to own a home. Keeping track of these changes helps buyers understand where they can afford to live and plan their home purchases better.